Hey, freshers! Have you filed your income tax?

One of the things that we often overlook as fresher is filing income tax. If you’re new to filing taxes, you might have these misconceptions:

- Filing income tax is only for those who earn more than RM XXX annually.

- Filing income tax = Paying tax

- Filing income tax is troublesome and involves a lot of procedures

But that’s not the case!

First of all, filing income tax ≠ paying tax. Thus it’s not something that you only need to do if your “annual income exceeds XXX amount”.

How to file your income tax in 2024

- 1. What is filling in income tax?

- 2. Who needs to do tax filing?

- 3. Do freelancers pay income tax in Malaysia?

- 4. What is the minimum salary to pay income tax in Malaysia?

- 5. How to file your tax online?

- 6. How do I register for LHDN for the first time?

- 7. How do I submit my income tax filing?

- 8. How do I file a return after the due date?

- 9. Extra tips: Filing income tax as a foreigner

1. What is filling in income tax?

From 1st March each year, employees and taxpayers can begin filing their income tax returns using the e-Filing system.

Unlike traditional methods where you manually fill out printed forms, e-Filing automatically calculates your income tax for you.

2. Who needs to do tax filing?

No matter you are self-employed or employed, all income earned in Malaysia, including salary and commission, is taxable.

We pay our taxes (cukai, which is tax in Malay) to the Inland Revenue Board of Malaysia (LHDNM – Lembaga Hasil Dalam Negeri Malaysia).

Effective since 2015, the law states that an individual employed in Malaysia that earns an annual employment income of RM34,000 (after EPF deduction) has to register for a tax file.

3. Do freelancers pay income tax in Malaysia?

When you work as a freelancer, you have the freedom to set your own schedule. However, you will still need to file your taxes once their annual income exceeds RM36,000/year.

All the money you earn from freelancing is considered business income if you’re registered as a sole proprietor.

This can actually be helpful because it means you can deduct certain expenses from your taxes, which you can’t do with personal spending accounts.

Good news is, if you’re earning money from companies based outside of Malaysia, you will not need to pay taxes on that income according to YA 2004!

Looking to save money on your taxes? Check out our comprehensive reading list of personal tax relief strategies!

👇 Read here 👇

List of Personal Tax Relief in Malaysia for YA 2023

4. What is the minimum salary to pay income tax in Malaysia?

Any individual who earns a minimum of RM 34,000 after EPF deductions.

It means individuals who earn RM 2,833 per month after EPF deductions from their salary or around RM 3,000 net.

The RM 34,000 is not only your income from work, but it should include all of your income into account.

Attached is the income tax rate as of year of assessment 2023:

| Chargeable Income | Calculation (RM) | Rate( %) | Tax(RM) |

| 0 – 5,000 | On the first 5,000 | 0 | 0 |

| 5,001 – 20,000 | On the first 5,000 Next 15,000 | 1 | 0

150 |

| 20,001 – 35,000 | On the first 20,000 Next 15,000 | 3 | 150 450 |

| 35,001 – 50,000 | On the first 35,000 Next 15,000 | 6 | 600 900 |

| 50,001 – 70,000 | On the first 50,000 Next 20,000 | 11 | 1,500 2,200 |

| 70,001 – 100,000 | On the first 70,000 Next 30,000 | 19 | 3,700 5,700 |

| 100,001 – 400,000 | On the first 100,000 Next 300,000 | 25 | 9,400 75,000 |

| 400,001 – 600,000 | On the first 400,000 Next 200,000 | 26 | 84,400 52,000 |

| 600,001 – 2,000,000 | On the first 600,000 Next 1,400,000 | 28 | 136,400 392,000 |

| Exceeding 2,000,000 | On the first 2,000,000 Next ringgit | 30 | 528,400 |

Overwhelmed by the numbers? Don’t worry! With the help of advanced technology, you can always file your tax online.

What’s better? The system will automatically calculate the payable amount for you!

5. How to file your tax online?

First things first! The due date for submission of Income Tax Returns is:

- Individuals without a business source: On or before 30 April every year

- Individuals with a business source: On or before 30 June every year

There are also some preparations to do in advance:

- Income Tax Reference Number (No Rujukan Cukai) SGXXXXXXX

- e-Filing PIN

You can visit the nearest LHDN office to apply for both.

You can apply online too.

Simply go to mytax.hasil.gov.my to apply for your Income Tax Reference Number. Click “Online Registration Form” (Borang Pendaftaran Online), fill in your details, and log in to your account.

As for your e-Filing PIN, you can go to LHDN’s website: Feedback>Application. Select e-Filing PIN Number Application.

However, the easiest way is to visit your nearest LHDN branch as the staff can assist you with all the applications.

6. How do I register for LHDN for the first time?

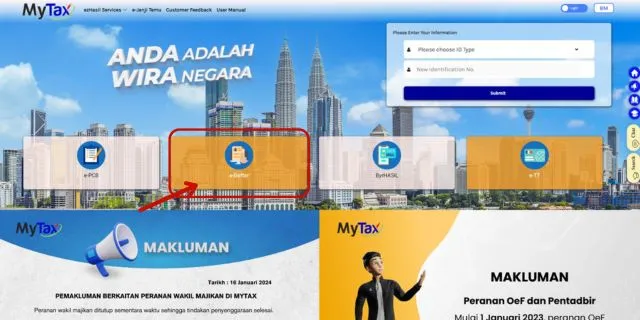

If this is your first time logging in, please choose ‘e-Daftar‘ on the MyTax website, and then fill in your PIN and identity your identity card (IC) number to complete the first step.

You will then have to fill in an online form and upload a digital copy of your identification card (IC) to serve as a supporting document.

You will then receive your PIN online, or if you prefer, you can visit the nearest LHDN branch to retrieve your PIN.

7. How do I submit my income tax filing?

1. Log in

I

Log in using your identification number (IC), Passport number, Army number or Police number, and input your password.

2. Choose your tax form

After logging in, you’ll find various tax forms for individuals from different sectors.

Usually, employed individuals will fill up Borang e-BE; self-employed individuals or employers will fill up Borang e-B. If you are a foreigner working in Malaysia, select Borang e-M.

The latest 2024 update of the LHDN website is quite advanced, as you can find the form that you need to fill in at ‘Status Borang E-filing’.

3. Fill in all the details

Next, you’ll see there are different sections in the form. Here, we fill in the ‘Borang e-BE’ for the employed individual.

In ‘Borang e-BE’, we need to fill in

- Personal Details (Maklumat Individu),

- Statutory Income (Pendapatan Berkanun)

- Tax Deduction/Rebate (Pelepasan Cukai/Tolakan Cukai)

*Pro Tip: Keep all the receipts you used for tax deduction/rebate as you might need to show them to the authorities if you were audited.

One good thing about filing your tax online is that the system will calculate the chargeable income and tax relief, showing you only the payable tax!

Now you don’t have to worry that you might get it wrong.

*If you don’t meet the taxable threshold after-tax deduction, the system will show 0 in the payable amount.

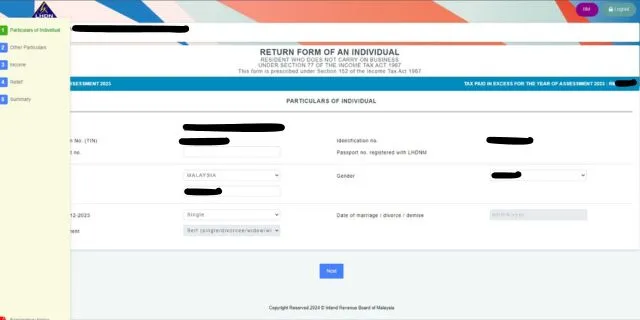

Your particulars

1

First, verify your personal details.

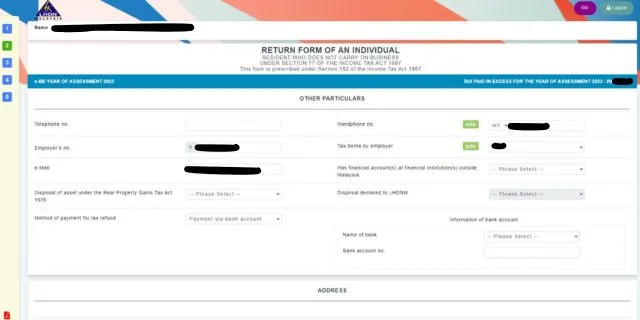

Other particulars

1. First, verify your personal details.

Verify your tax information. Make sure to key in your bank account details accurately so that you can receive your tax refund (if any)!

Statutory and total income

2. Verify your tax information. Make sure to key in your bank account details accurately so that you can receive your tax refund (if any) without much trouble

This is where you fill in your income! Fill in the information according to the EA form provided by your company. You need to list down any part-time or rental income.

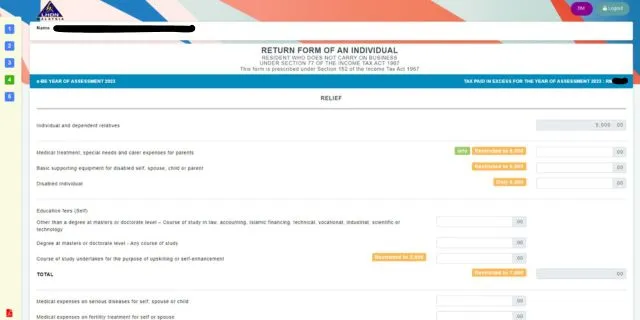

Relief

This is where you claim all of your tax reliefs! Fill in the details and let the system calculate for you.

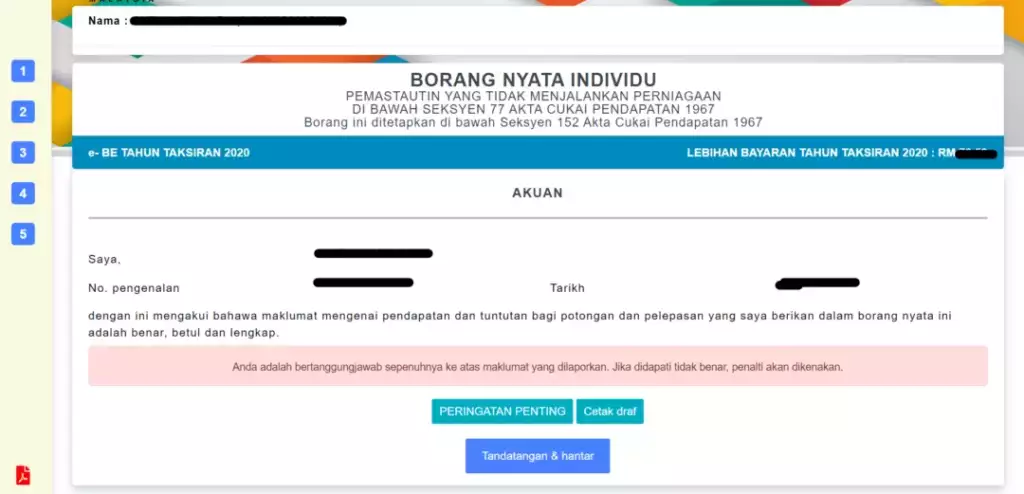

Summary

You’re almost done! This page shows you the summary of your income, tax relief and the final payable tax (if applicable). Make sure to check if all of your details are correct here.

4. Submit

After reviewing your details, click ‘Teruskan’ under ‘Summary’ (Rumusan), then click ‘Tandatangan & Hantar’ and it will bring you to the ‘Pengesahan Penerimaan’ page.

Before signing, you can click ‘Cetak draf’ to download and save your file.

Congratulations, you just finished filing your income tax!

8. How do I file a return after the due date?

If individuals or companies miss the deadline for filing their taxes, they could face penalties.

The penalties include a 10% fine for late filing, as well as fines ranging from RM200 to RM20,000, or imprisonment for up to six months, or both, as stated in the Income Tax Act 1967.

To avoid these penalties, taxpayers should stay informed about the tax deadlines and make sure to file their taxes on time.

9. Extra tips: Filing income tax as a foreigner

Foreigners who stay and work in Malaysia for more than 182 days are subject to tax, and they must file and pay their tax to the Inland Revenue Board of Malaysia.

On the other hand, according to the Income Tax Act 1967, only income derived from Malaysia is subject to income tax in Malaysia, while income earned outside Malaysia is not subject to tax.

For example, Malaysians working in Singapore will have to file and pay their tax in Singapore; thus there’s no need to file and pay their tax to the Inland Revenue Board of Malaysia.

More details:

- If a foreign company employed the taxpayer and he doesn’t work in Malaysia and only provides services abroad, the income will be considered foreign-sourced. There will be no need for the taxpayer to file and pay the income tax in Malaysia.

- But, if the taxpayer provides services for a foreign company through mobile or internet in Malaysia, indicating that his/her income was derived from Malaysia, then he/she must file and pay the income tax.

- If a Malaysian resident individual uses the foreign-sourced income to buy properties and earn rental income in Malaysia, then he/she must pay the income tax.

With a team of over 25,000 real estate agents worldwide, not only can you sell properties in Malaysia, you can also expand your career globally.

Interested to join IQI?

Leave your contact information below and our team will contact you as soon as possible!

Continue reading: