It’s tax filing season!

We’ve come to the time of year where everyone in Malaysia is busy filing taxes (or learning how to – we have just the guide for the tax filing process for you!).

Even though you have to pay tax on your chargeable income when your annual salary reaches a certain amount, did you know that you can get tax relief benefits from filing your taxes?

Keep all of your receipts! Let’s see what you can claim when filing your taxes with the Inland Revenue Board Malaysia:

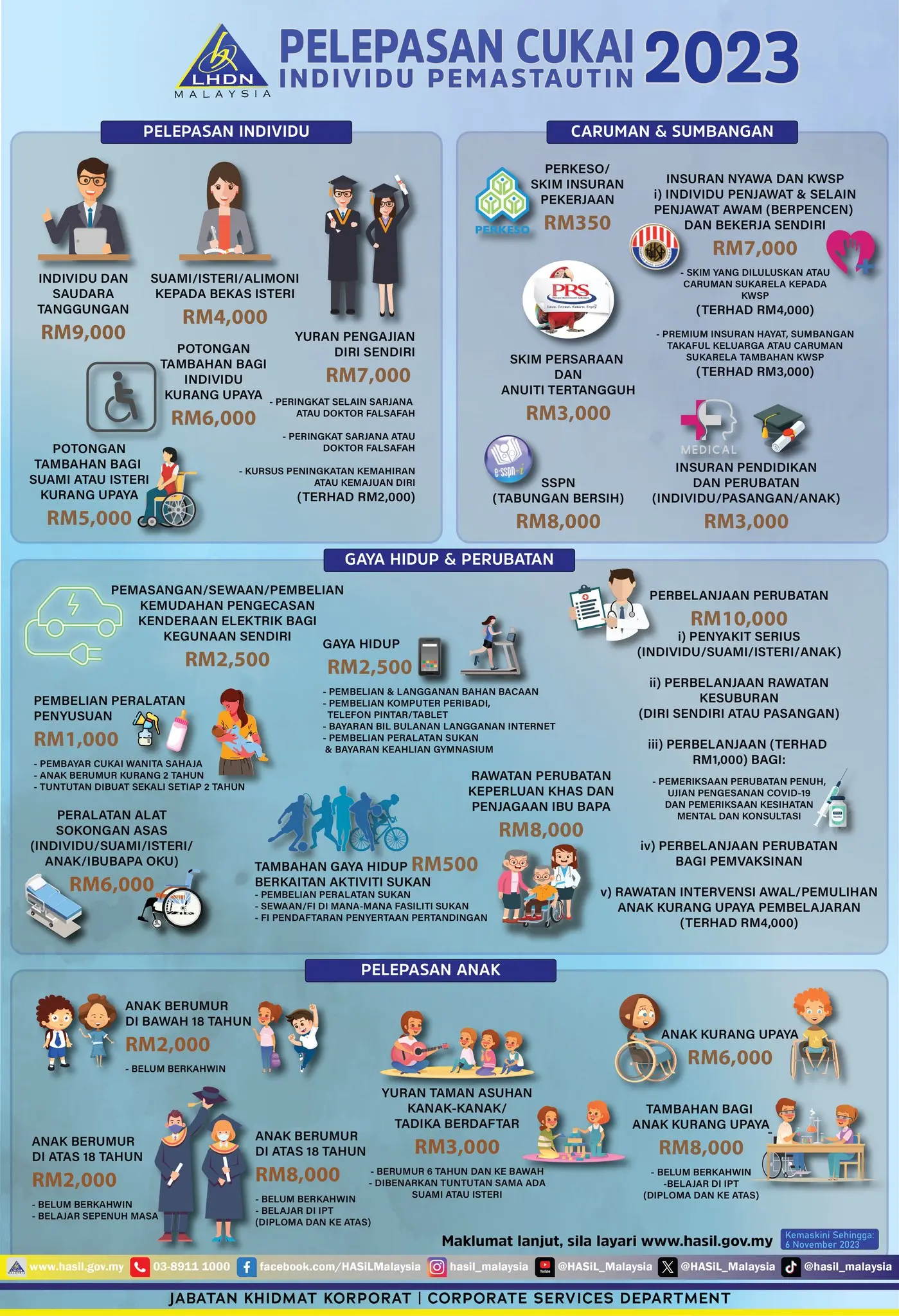

List of Income Tax Relief for Year of Assessment 2023

| Relief types | Amount |

| Tax relief for individual/spouse | |

| Individual and dependent relatives | RM9000 |

| Husband / wife / payment of alimony to former wife | RM4000 |

| Education fees (Self): – Other than a degree at masters or doctorate level – Course of study in law, accounting, Islamic financing, technical, vocational, industrial, scientific or technology – Degree at masters or doctorate level – Any course of study – Course of study undertaken for the purpose of upskilling or self-enhancement (Restricted to RM2,000) | RM7000 |

| Disabled individual | RM6000 |

| Disabled husband/wife | RM5000 |

| Statutory contributions | |

| Life insurance & EPF – Mandatory contributions to approved schemes or voluntary contributions to EPF (excluding private retirement schemes) – Life insurance premium payments or family takaful contributions or additional voluntary contributions to EPF | RM7000 |

| Education or medical insurance | RM3000 |

| SOCSO & EIS | RM350 |

| Private Retirement Scheme (PRS) | RM3000 |

| SSPN Net Savings | RM8000 |

| Life, medicine and health-related equipment | |

| Medical treatment, special needs and carer expenses for parents | RM8000 |

| Medical expenses on: – Serious diseases for self, spouse or child – Fertility treatment for self or spouse – Vaccination for self, spouse and child (Restricted to RM1,000) | RM8000 |

| Lifestyle (expenses for self, spouse or child): – Purchase/subscription of books, journals & other similar publications – Sports equipment & gym membership fee – Personal computer, tablet, smartphone (not for business use) – Monthly internet fee (under own name) |

RM2500 |

| Additional sports-related activities: – Purchase of sports equipment – Sports venue rental/entry fee – Registration fee for sports competition |

RM500 |

| Expenses on charging facilities for Electric Vehicle (Not for business use) |

RM2500 |

| Purchase of breastfeeding equipment for own use for a child aged 2 years and below (Deduction allowed once in every TWO (2) years of assessment |

RM1000 |

| Purchase of basic supporting equipment for disabled self, spouse, child or parent | RM6000 |

| Child relief | |

| Unmarried children under the age of 18 (per person) | RM2000 |

| Unmarried student over the age of 18 studying for a higher education diploma or above – Diploma – Bachelor, Masters, Doctorate | RM8000 |

| Nursery / Kindergarten (under 6 years old) | RM3000 |

| Disabled children | RM6000 |

If you’re thinking of saving more money, remember to fill in these tax deductions when you file your tax – and get additional relief from paying less tax, or no tax at all!

IQI is constantly expanding! With a positive working environment that encourages continuous growth, joining us as a real estate negotiator might be your best choice. Drop your details below!

Continue reading: