Malaysia Income Group: B40, M40, and T20

B40, M40, T20 in Malaysia. Everyone has heard of these income-related terms before.

Household per capita income is considered as family income that only households occupied by two/more people related by marriage, birth, or adoption, and it measures the income earned by each individual in a given area.

What exactly do these classifications mean? Read on to find out!

1. Malaysia income group classifications

According to the 2019 statistics in Malaysia, our government classified our population into three main groups based on their gross monthly household income:

- B40 meaning bottom 40% (low income)

- M40 meaning medium 40% (average income)

- T20 meaning top 20% (high income)

*Post-COVID in 2021, URUS introduced the B50 income group, categorized as under 50 percent of the low-income group, for those with a monthly income of RM 5,880 or lower and experiencing loss of employment & income reduction of at least 50%.

However, this income group is no longer relevant now.

What is B40 in Malaysia?

B40 represents the Bottom 40% of low-income earners. They are the bottom-tier families that have an income of less than RM4850.

What is M40 in Malaysia?

M40 represents the Medium 40% of average income earners. They are medium-tier families that have an income of between RM4850 to RM10959.

What is the difference between B40 and M40?

The B40 and M40 groups have different income tiers, which affect the types of aid and assistance they are eligible to apply for.

What is T20 in Malaysia?

T20 represents the Top 20% of Top income earners. They are Top tier families that have an income higher than RM10959.

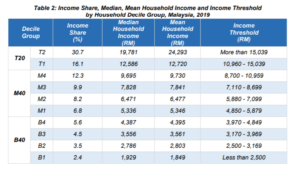

The B40, M40, and T20 income groups are further classified according to the 2019 Malaysia Statistics. Take a look at the table below!

2. As for B40/M40/T20, what can I expect from Malaysia Budget 2023?

The Malaysian government announced the latest Malaysia Budget 2023 under Malaysia Madani. How can we benefit from it?

The following are some incentives provided under Belanjawan 2023: Malaysia Madani:

1. Income tax rate changes

Some changes were made for income tax rates as follows:

Annual income:

B40 and M40 earning RM35,000 – RM100,000: decreased by 2%

T20 earning RM100,000 – RM1,000,000: 0.5 – 2% increase

2. Sumbangan Tunai Rahmah (STR)

Households with an income of less than RM2500 are eligible to receive a donation of up to RM2500 depending on the number of children, with an additional donation of RM600 to the poorest STR recipient households distributed in the form of food baskets and vouchers for basic food items.

3. RM200 e-Tunai Belia Rahmah for youths

Youths aged 18 to 20 can claim e-Tunai Belia Rahmah credit amounting to RM200.

Read more about Malaysia’s budget for 2023 here!

IQI Global is here to cultivate your future success! Become a REN with us today – this opportunity doesn’t come by often. Sign up below!